Open up Door Financial loans and doorstep funds lending have gained reputation as effortless and flexible options for individuals in need of brief economic assistance. These types of lending expert services allow borrowers to access cash without having to endure the standard, often lengthy, financial loan software procedures linked to banking companies or other significant economical institutions. Although the appeal of these kinds of loans could lie in their simplicity and accessibility, it’s vital that you totally have an understanding of the mechanisms, pros, and possible pitfalls ahead of thinking about this type of economic arrangement.

The concept powering open doorway loans revolves around delivering easy and rapidly access to cash, ordinarily with no need to have for intensive credit rating checks or collateral. This helps make these loans appealing to individuals who might not have the most effective credit scores or people that experience economic challenges. Compared with classic financial loans that will consider days or even months being authorised, open doorway loans generally deliver hard cash to the borrower’s account in a subject of several hours. This velocity and benefit are two of your most important components contributing on the rising attractiveness of these lending providers.

The process of implementing for these financial loans is straightforward. Frequently, borrowers have to have to deliver primary own details, proof of revenue, and lender particulars. Because open up door financial loans are often unsecured, lenders take on extra hazard by not necessitating collateral. Consequently, the fascination charges and fees connected to these financial loans are typically better as opposed to conventional lending solutions. Although This may be a downside, the accessibility and speed of funding generally outweigh the higher costs For a lot of borrowers in urgent fiscal situations.

Doorstep income lending, because the title implies, entails the delivery of money straight to the borrower’s dwelling. This service is built to cater to those preferring in-man or woman transactions or individuals that may well not have entry to on-line banking facilities. A representative within the lending firm will go to the borrower’s home to hand about the income and, in several scenarios, obtain repayments on the weekly or regular monthly foundation. This particular touch can provide a way of reassurance to borrowers, In particular those who can be wary of online transactions or are considerably less familiar with digital economical expert services.

Even so, just one must evaluate the better desire prices and fees frequently linked to doorstep cash lending. A lot of these loans are thought of high-possibility by lenders, given that they're unsecured Which repayment assortment depends seriously around the borrower’s capacity to make payments as time passes. As a result, the curiosity rates billed is usually considerably bigger than Individuals of ordinary financial loans. Borrowers needs to be cautious of the, as being the advantage of doorstep money lending might arrive at a considerable Value.

A different factor to look at would be the repayment versatility that these financial loans give. A lot of open doorway loans and doorstep hard cash lending products and services deliver versatile repayment choices, which may be helpful for borrowers who might not be in the position to commit to stringent payment schedules. Having said that, this adaptability can also produce for a longer period repayment intervals, which, combined with substantial curiosity fees, could cause the borrower to pay for substantially much more over the lifetime of the loan than they to begin with borrowed. It’s essential to evaluate whether or not the repayment construction of those financial loans is actually manageable and in line with one’s financial problem right before committing.

One of many important elements of open up door loans is their potential to accommodate persons with inadequate credit history scores. Conventional banking companies often deny loans to those with a lot less-than-perfect credit rating histories, but open up door lenders have a tendency to concentration more within the borrower’s existing capacity to repay rather then their credit score past. Although This may be advantageous for anyone seeking to rebuild their economical standing, it’s vital being aware with the risks associated. Failing to satisfy repayment deadlines can more damage a person’s credit history score and perhaps produce additional significant economical difficulties down the road.

The approval course of action for these loans is often fast, with decisions manufactured within a couple several hours, and cash in many cases are readily available precisely the same working day or the next. This immediacy helps make these loans a lifeline for individuals experiencing surprising expenses or emergencies, including vehicle repairs, health care expenses, or other unexpected financial obligations. However, the benefit of entry to cash can sometimes produce impulsive borrowing, which could exacerbate monetary challenges rather than resolve them. Borrowers should really usually think about whether they definitely will need the mortgage and whenever they should be able to find the money for the repayments ahead of proceeding.

One more advantage of doorstep funds lending is that it enables borrowers to obtain money with no will need to go to a lender or an ATM. This can be notably beneficial for people who may possibly are in remote places or have limited entry to fiscal institutions. Also, some borrowers may experience far more comfy working with a agent in human being, especially if they have got considerations about handling economical transactions online. The non-public character in the services can foster a more robust partnership amongst the lender as well as the borrower, but it really is vital to do not forget that the higher price of borrowing remains an important thought.

There is also a specific amount of discretion involved with doorstep funds lending. For individuals who may well not want to reveal their money predicament to Other people, the ability to tackle loan arrangements within the privacy in their residence might be pleasing. The non-public conversation by using a lender representative could also give some reassurance, as borrowers can explore any problems or issues straight with the person offering the bank loan. This immediate interaction can at times make the lending approach feel less impersonal than working with a faceless on the web application.

To the draw back, the convenience of doorstep hard cash lending can from time to time bring about borrowers using out a number of loans simultaneously, especially if they find it hard to keep up with repayments. This will make a cycle of personal debt that's difficult to escape from, particularly If your borrower is just not controlling their funds thoroughly. Responsible borrowing and a clear comprehension of the financial loan conditions are essential to steer clear of these types of circumstances. Lenders may perhaps offer repayment plans that appear flexible, nevertheless the significant-curiosity rates can accumulate rapidly, bringing about a big personal debt burden over time.

When open door financial loans and doorstep cash lending provide different Rewards, including accessibility, speed, and flexibility, they're not devoid of their problems. Borrowers really need to very carefully evaluate the stipulations of such financial loans in order to avoid receiving caught within a personal debt cycle. The temptation of quick income can at times overshadow the prolonged-time period financial implications, specifically Should the borrower is not really in a solid place to help make well timed repayments.

One of the first factors for any borrower should be the entire expense of the financial loan, including interest fees and any extra service fees. Whilst the upfront simplicity of those financial loans is captivating, the actual total repaid eventually might be substantially higher than expected. Borrowers will have to weigh the quick benefits of acquiring dollars promptly against the extensive-phrase fiscal impression, notably When the bank loan phrases lengthen around many months as well as years.

Furthermore, borrowers must also pay attention to any opportunity penalties for late or missed payments. Many lenders impose steep fines for delayed repayments, which could additional enhance the whole expense of the loan. This can make it much more crucial for borrowers making sure that they've got a good repayment strategy in position ahead of getting out an open up door bank loan or deciding on doorstep hard cash lending.

Regardless of the likely disadvantages, there are scenarios in which open up door financial loans and doorstep dollars lending can be beneficial. For individuals who will need access to resources immediately and do not have other feasible fiscal selections, these financial loans supply an alternate that can help bridge the gap throughout complicated occasions. The important thing is to implement these loans responsibly and ensure that they are Portion of a effectively-imagined-out fiscal tactic as opposed to a hasty determination driven by quick requirements.

In some instances, borrowers may well learn that these financial loans function a stepping stone to much more stable money footing. By generating timely repayments, people today can reveal economic accountability, which can increase their credit rating scores and allow them to qualify for more favorable loan terms in the future. Nonetheless, this outcome depends greatly about the borrower’s capacity to deal with the personal loan proficiently and avoid the pitfalls of substantial-interest personal debt.

It’s also really worth noting that open up door loans and doorstep money lending are frequently subject to regulation by economical authorities in many nations around the world. Lenders have to adhere to particular recommendations regarding transparency, curiosity prices, and repayment phrases. Borrowers should really assure that they are handling a legitimate and regulated lender to prevent probable scams or unethical lending procedures. Examining the lender’s qualifications and examining assessments from other borrowers may also help mitigate the risk of slipping target to predatory lending strategies.

In conclusion, open doorway loans and doorstep funds lending offer a easy and obtainable Resolution for people going through speedy economical challenges. Though the ease of acquiring these loans may be captivating, it’s critical to solution them with caution and a clear pay weekly doorstep loans idea of the involved charges and threats. Borrowers should really very carefully Appraise their capacity to repay the financial loan inside the agreed-upon phrases and pay attention to the probable very long-term economical effects. By doing this, they could make knowledgeable conclusions that align with their fiscal targets and steer clear of the widespread pitfalls of higher-fascination lending.

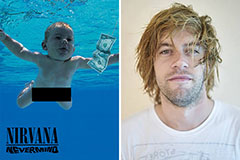

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!